In the full process of enterprise revenue management, the reconciliation step is a critical juncture—it connects transaction data with cash flow and directly determines the accuracy and compliance of revenue data. However, traditional manual reconciliation has become a major bottleneck limiting efficiency: financial personnel must match each item across hundreds or even thousands of orders, invoices, and bank statements, painstakingly searching for discrepancies like finding a needle in a haystack. This process is not only time-consuming and labor-intensive, but also prone to high error and omission rates due to subjectivity and fatigue in manual operations.

Yonyou BIP Revenue Cloud 8.0 addresses this challenge with AI-powered reconciliation, driven by an intelligent engine at its core. Leveraging a dual approach of “line-item-level reconciliation models + rolling discrepancy resolution,” it delivers a leap from manual matching to intelligent verification. This transformation enables enterprise revenue reconciliation to shift from chaotic and inefficient to precise and streamlined.

01 Line-Item-Level Reconciliation Model: Comprehensive Coverage of Business Scenarios

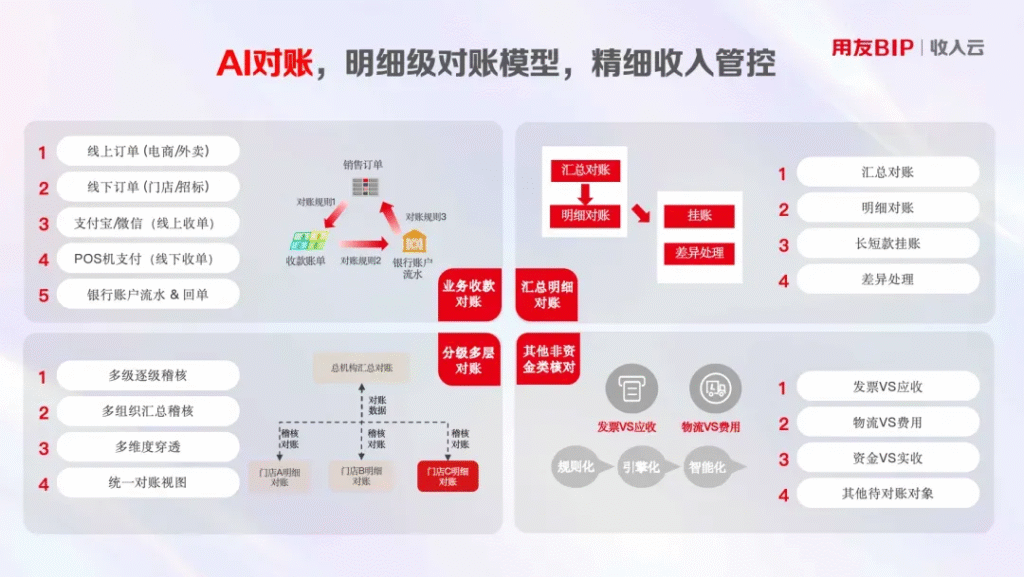

The limitations of traditional reconciliation largely stem from its coarse approach—primarily focusing on total amount matching, which makes it difficult to drill down into transaction details. As a result, discrepancies hidden beneath aggregated data often go unnoticed. Yonyou BIP Revenue Cloud 8.0 addresses this with an AI-powered reconciliation engine built on a line-item-level model, establishing a multi-dimensional, all-scenario verification framework that ensures every transaction is clear, traceable, and accurate.

From a reconciliation dimension perspective, Yonyou BIP Revenue Cloud covers all key nodes across the entire enterprise revenue management chain: matching orders with settlement slips, reconciling invoices with accounts receivable, validating logistics data against expense details, and comparing cash flow with actual received payments. This multi-dimensional, cross-referenced verification framework builds a comprehensive protection net for revenue data, ensuring that any discrepancies at any stage are accurately detected.

From a business scenario perspective, Yonyou BIP Revenue Cloud supports both 2C and 2B business models. For 2C e-commerce enterprises, the system can automatically match online orders from platforms like Douyin and Tmall with settlement slips from Alipay and WeChat Pay, even recognizing differences caused by promotions such as coupons and discounts. For 2B manufacturing enterprises, it connects customer contract orders in ERP systems with bank payment confirmations, accurately verifying receivables within the billing cycle. Whether it’s POS data from offline stores or foreign exchange settlement slips from cross-border trade, the system adapts to diverse reconciliation needs through predefined rule engines and AI-powered learning capabilities.

This comprehensive, all-scenario coverage transforms the traditional one-to-one, manual reconciliation model into intelligent many-to-many matching for complex business scenarios.

02 Rolling Discrepancy Resolution: No More Hiding for Errors or Mismatches

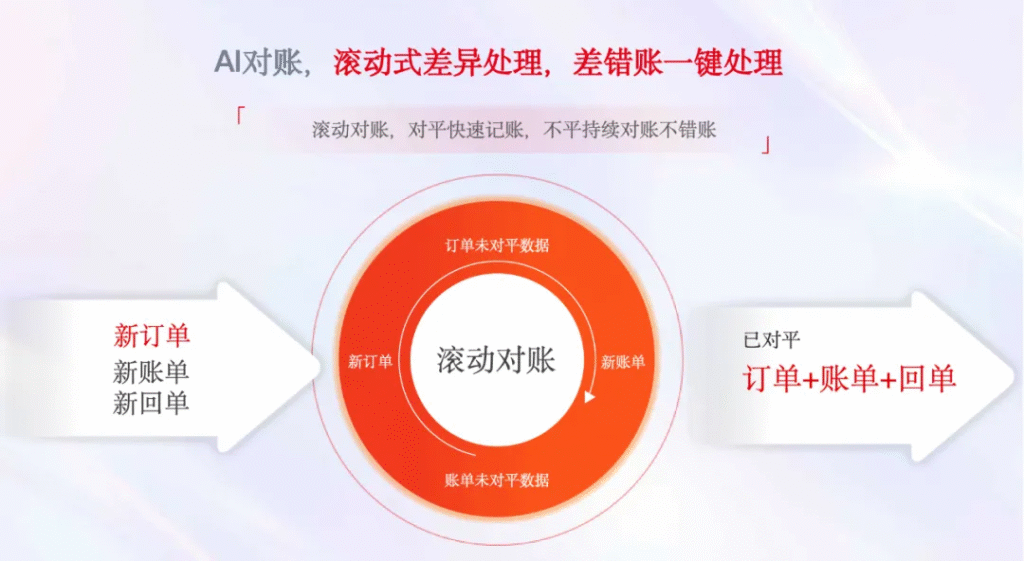

The core value of reconciliation lies not only in matching data, but also in efficiently resolving discrepancies. In traditional manual processes, when inconsistencies such as shortfalls or mismatched amounts occur, financial staff often need to sift through documents one by one and coordinate across departments—a process that can take days or even weeks, and still result in accumulated errors due to human oversight.

With Yonyou BIP Revenue Cloud 8.0, the rolling discrepancy resolution mechanism automates and streamlines this entire process—reducing it to just a single click.

For example, if a payment for a particular order is delayed by the bank, causing a mismatch on the day of reconciliation, the system will automatically move the transaction into a pending verification pool. Once the bank confirmation arrives the next day, it will automatically match with the corresponding order—no manual intervention required. This continuous reconciliation model effectively solves the traditional challenge of tracking cross-period discrepancies.

For discrepancies that do require manual intervention, the system offers one-click resolution features: it supports categorization of discrepancy reasons and automatically routes them to the relevant business departments for confirmation. The resolution results are instantly synchronized with the financial system, updating the reconciliation status and generating adjustment entries automatically.

03 From Efficiency Revolution to Value Rebuilding: The Deeper Value of AI Reconciliation

AI-powered reconciliation delivers more than just efficiency gains—it redefines the entire revenue management model:

• Significantly reduces labor costs and error rates:

Traditional manual reconciliation has an average error rate of 3–5%, while AI reconciliation can reduce it to below 0.1%. For instance, after implementation at a retail chain, the finance reconciliation team was reduced from 12 people to 3, cutting labor costs by 75% and saving the company over one million RMB annually by preventing error-related losses.

• Strengthens financial compliance and risk control:

The system comes with built-in, industry-standard reconciliation rules and tax compliance requirements. It automatically checks the consistency between invoices and orders to ensure alignment across invoice, goods, and payment, thereby reducing tax audit risks. For cross-border transactions, it can automatically detect exchange rate differences in foreign currency settlements, ensuring compliance with international accounting standards.

• Enables refined management through data support:

The detailed data generated by AI reconciliation is synchronized with the enterprise’s data lake, providing accurate input for revenue analysis and profit calculation.

In today’s increasingly uncertain economic environment, accurate revenue data is not just the foundation of financial compliance—it’s the compass for enterprise decision-making.

Yonyou BIP Revenue Cloud 8.0 breaks through scenario limitations with line-item-level reconciliation, tackles discrepancy challenges with rolling resolution, and supports management decisions through closed-loop data processes—delivering solid assurance for enterprises to thrive in a complex market landscape.